Our Approach

Since inception, Everstone has built a world-class alternatives platform rooted in responsible investing. Guided by the IFC Performance Standards since 2015, ESG integration is embedded across all our businesses. We focus on transformative global themes, applying a rigorous screening process followed by due diligence with defined checkpoints to manage risk and impact.

Responsibility for risk and impact is shared across deal teams, operations, and portfolio boards, reflecting our belief that every professional at the Everstone group is a custodian of this commitment. Our Executive Chairman leads the group-wide Responsible Investing Committee to ensure alignment, oversight, and accountability.

Through our control-oriented growth strategy and best-in-class practices, we aim to deliver measurable environmental and social impact alongside strong financial returns. We also align with the principles of TCFD, CDP, UNPRI, and India’s Climate Goals to support the global net-zero transition.

Impact Management Framework

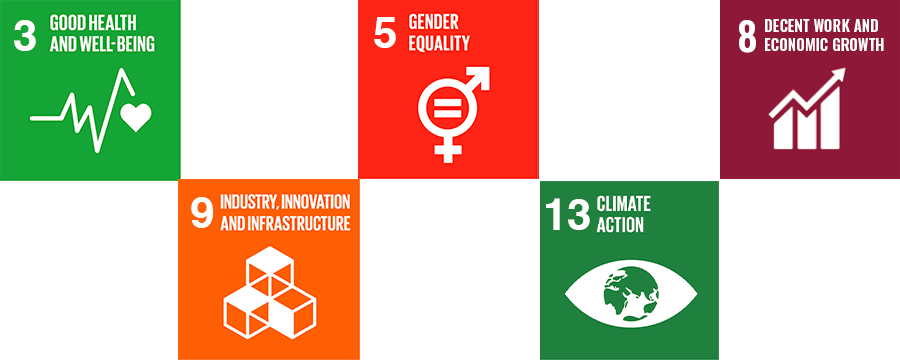

Our proprietary framework to evaluate impacts align with the principles of IFC’s Anticipated Impact Measurement and Monitoring (AIMM), Operating Principles for Impact Management (OPIM), the Impact Management Project (IMP) and principles of “Need, Access, Reach and Quality”. We align the identified impacts with the UN SDGs which further assists us in defining the key KPIs for us and the company to monitor. While we are not a traditional impact fund, our strategy drives meaningful outcomes—expanding access to essential healthcare, technology, and services, creating high-quality jobs, and improving quality of life across India and Southeast Asia.

We develop an Impact Thesis for each portfolio companies across our sectors focusing on five key UN SDGs.